1st Mortgage Loans

Did you know Woodmen Federal Credit Union offers mortgage loans? The Credit Union, in partnership with Pivot Lending Group, is here to assist you whether you are purchasing a new home or refinancing your existing home. We offer a variety of mortgage solutions to help...

Considering a Home Equity Loan?

Considering a Home Equity Loan? Woodmen Federal Credit Union is offering 6.99% APR fixed rate home equity loans. Design your home office, consolidate debt, buy a new car, pay tuition, whatever! Plus, the interest may be tax deductible. Consult your income tax...

HOME EQUITY LINE of CREDIT

In addition to our fixed rate Home Equity Loan, the Credit Union offers a simple and convenient Home Equity Line of Credit. Once you have established your home equity credit line the paperwork is done. Future advances are simple and fast. The interest you pay on...

125% STICKER PRICE FINANCING

Woodmen Federal Credit Union is offering 125% auto loan financing at special discounted rates through May. You may borrow up to 84 months on new and used vehicles, depending on the model year of the vehicle. New vehicle rates begin as low as 6.49% APR with qualifying...

LOAN CALCULATORS / VEHICLE VALUE GUIDES / 84-MONTH TERMS

Woodmen Federal Credit Union offers online loan tools and the right terms to help you find your new vehicle. The Credit Union finances new and preowned vehicle loans up to 84 months, depending on the model year of the vehicle. Financing your new vehicle forthe...

GUARANTEED ASSET PROTECTION

Woodmen Federal Credit Union also offers GAP, Guaranteed Asset Protection. GAP will cover most deficiency balances between your insurance settlement and your Credit Union loan balance if your car were to be totaled in an accident or stolen. Ask in the Credit Union...

RISK-BASED LENDING

Our Risk Based Lending is designed to reward you with a lower Annual Percentage Rate on your loan application as determined by your credit bureau credit score and your credit relationship with the Credit Union. The better your credit bureau score the lower your rate!...

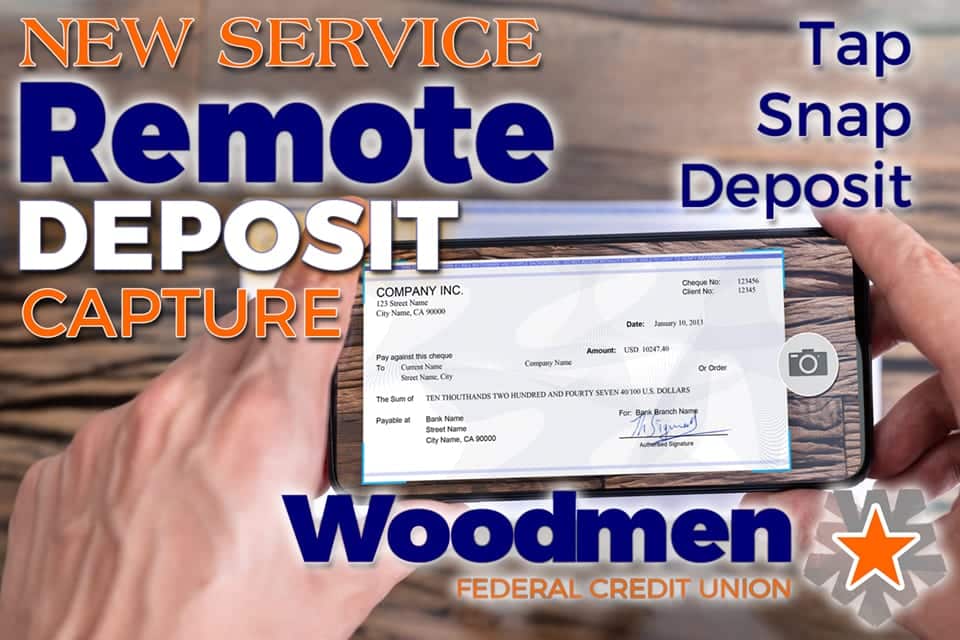

ONLINE AND REMOTE SERVICES

Woodmen Federal Credit Union now offers our new Remote Deposit Capture service or ‘DeposZip’. Online banking is more important than ever as the pandemic has accelerated consumer adoption and use of digital banking tools, particularly convenience utilities like mobile...